How Dent coin price prediction 2030 - Everybody's Favorite Deck Guy can Save You Time, Stress, and Money.

COIN - Coinbase Global Inc Forecast - CNNMoney.com for Beginners

On the contrary, tokens (e. g., ERC-20) can be exchanged through internal applications with very little friction since they are built on standardized code procedures. Analyzing crypto cost trends is important for traders as it alerts them about the correct time to enter the market. It also assists traders choose whether to purchase, offer, or hold the cryptos to enjoy the maximum advantages.

The technical analysis depends on the idea that crypto costs follow trends and repeats themselves. For that reason, analysts concentrate on analyzing the price movements and trading volumes to anticipate the future instructions of crypto rate, whether it will go up or fall in the future. Instead of depending on the historic rate patterns, fundamental analysis takes a various approach.

Ethereum Price Prediction for 2021, 2022-2025 and Beyond - LiteForex

It focuses on the fact that the worth of a cryptocurrency can be both underestimated or miscalculated, and then it is time to make corrections. As the name suggests, the emotional analysis puts the trader's beliefs and emotions into anticipating the crypto cost patterns. Instead of relying entirely on the marketplace data, crypto analysts focus on emotional patterns like panic selling or an acquiring spree based upon public expectations and perceptions.

Bitcoin price: Top cryptocurrency prices today: XRP, Dogecoin, Polkadot add up to 6% - The Economic Times

Excitement About DNT PRICE - RECICLAJEHIMECA.COM

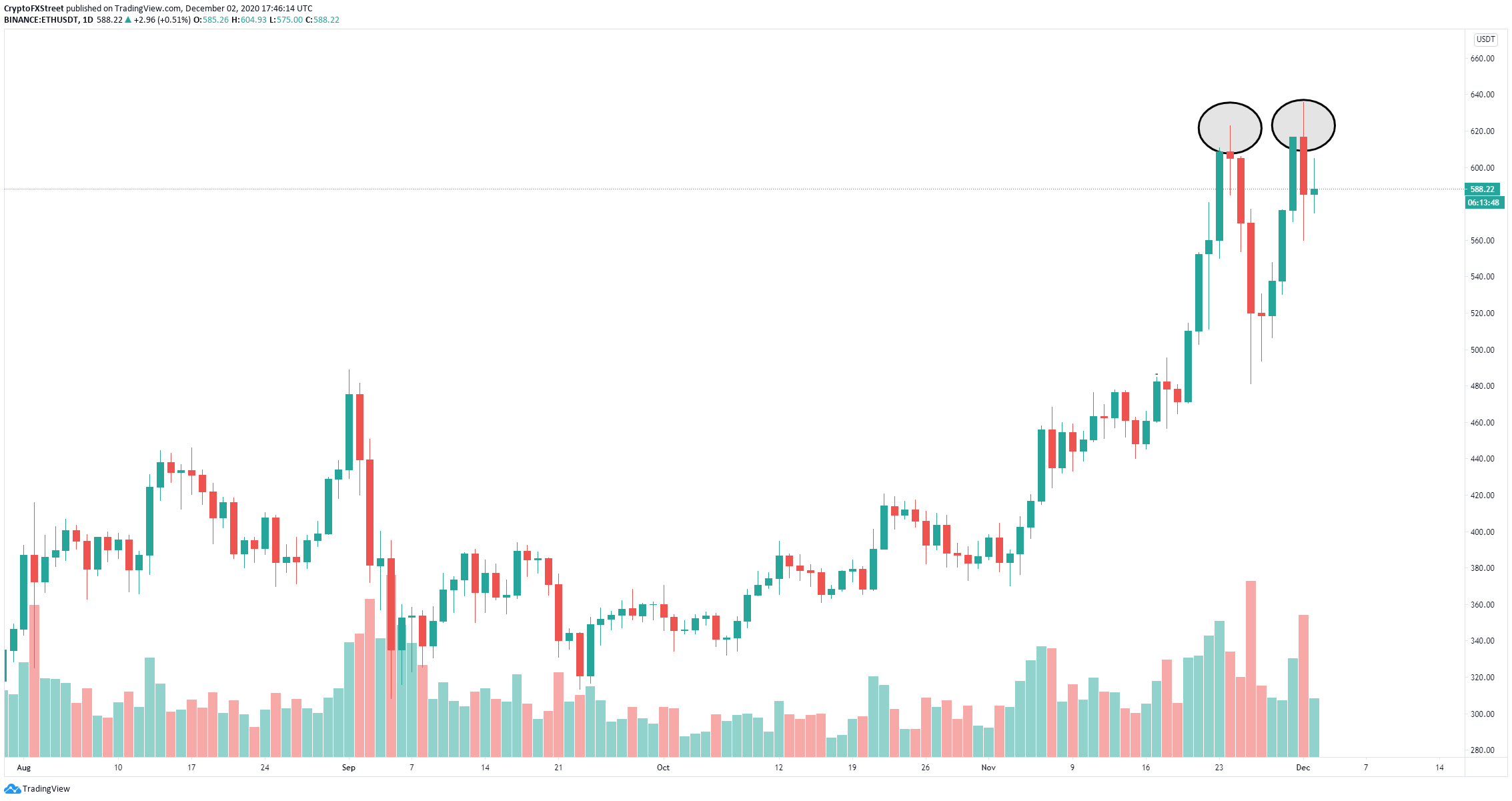

A candlestick is a type of price chart utilized while carrying out technical analysis that displays high/low, open/closing costs of a derivative, security, or a currency. There are Related Source Here of a candlestick chart: Natural Body: The distinction between the opening and the closing rates is shown by the colored part on the candlestick chart.

Lower Shadow: The vertical line between the lowest cost of the day and the opening rate (in case of bullish trend) or closing cost (in the bearish pattern). Candlestick chart patterns can be divided into 2 primary categories- bullish patterns and bearish patterns, which are further partitioned into the following classifications: Under the bullish patterns come the list below types: This pattern suggests that an intense buying spree causes a surge in the rates in spite of having selling pressures.